Contents

I also recommend checking the costs from the payment processor to the bank account unless a debit/credit card is available. MT4 has thousands of EAs, and traders may explore them to determine if they suit their trading style. Additions https://limefx.name/ such as account overviews and VIP webinars attempt to give the account upgrades relevance, ignoring the needs of active traders. Negative balance protection exists, ensuring traders can never lose more than their deposit.

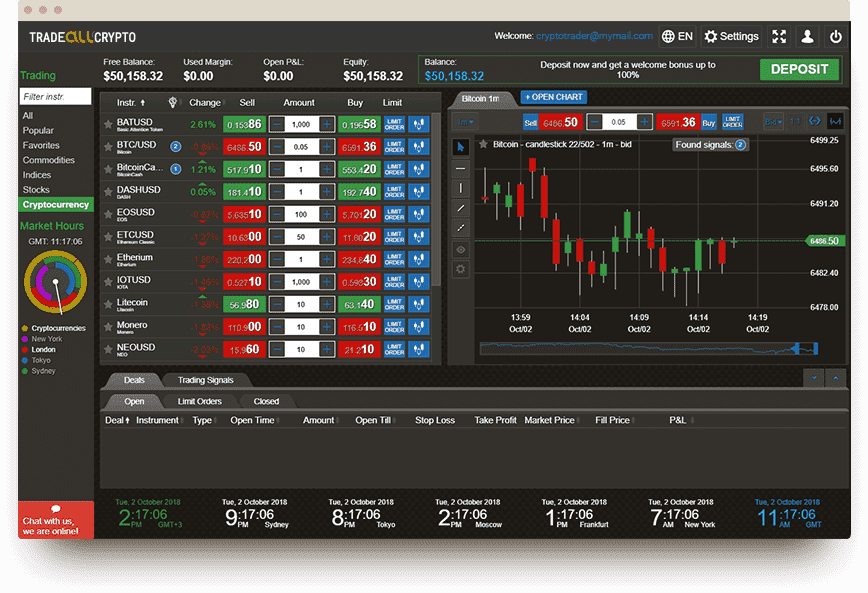

The selection of currency pairs is alright, while the choice of cryptocurrency CFDs is severely lacking. The broker isn’t very transparent when it comes to educating potential clients. Their spreads and even leverage information aren’t readily available through their website, requiring users to set up a demo account to get a peak. The broker also has a proprietary WebTrader platform for its users. Their platform features some useful features, including one-click trading and asset alerts. There are a variety of analyses available through risk management tools and the platform’s popularity bar.

The satisfied trader here. Withdrawal is always fast and signals are all the time profitable. Great trading platform and has good services.

FBS Markets Forex Trade Platform and Broker Review

They have so many good opportunities to earn money. They are very dedicated to helping me grow my LimeFX. I meet this broker just in time. I was about to give up due to consecutive losses, but they have helped me recover. Both MetaTrader and the LimeFX Trader are excellent, with intuitive interfaces and analytical features.

Their custom platform leaves a lot to be desired. The broker already offers MetaTrader 4, and it isn’t apparent why any trader wouldn’t just go with that. $250 is a bit high for opening an account, but no unheard of.

If you don’t want to risk, try to enter earlier. It would be much better than trying to enter the market when you already see a giant candlestick. Good broker company. They are very professional and skilled in trading forex and cfd’s.

How many employees do work for LimeFX?

Forex trading bears intrinsic risks of loss. You must understand that Forex trading, while potentially profitable, can make you lose your money. Never trade with the money that you cannot afford to lose! Trading with leverage can wipe your account even faster. The Classic account only requires $250 to open but is lacking many of the features of the higher accounts.

I always have smooth and fast withdrawals of profit. Excellent trading signals and good customer service. I am happy and satisfied with this broker. Over 40 video lessons are available through LimeFX’s media center.

Traders based in the EEA or Switzerland can find in LimeFX a reliable trading partner, considering the brand is backed by a well-known Cyprus LimeFX firm. At the same time, there is a very efficient customer support service available via live chat, email, or phone 24/7. This isn’t something common among online brokers, most of them provide support only during business days.

Does LimeFX have a mobile app for Forex trading?

I have been trading for many years now and tried several brokers. This is one of the best brokers I ever had encountered. They have excellent trading conditions, an easy deposit limefx broker reviews and withdrawal process, and reliable trading signals. Lastly, we’d like to mention its stand-out educational experience once more, as it allows users to progress quickly.

- Leverage remains fixed for all account types, without the necessary risk management tools for active traders with higher deposits.

- I don’t like to dig in reviews.

- The minimum amount for all of them is 250 in the currency chosen.

- I have been trading for many years now and tried several brokers.

Instead of sending another profit, i decided to withdraw my $200 but surprisingly Ihsancan begged me to do one more trades to the point ived lost everything. Then he ever said try to withdraw it now from the fact that he new i got nothing left. To this company hope no one can be a victim from them again. Although trading conditions are relatively the same, there are some differences in terms of spreads and trading benefits for Gold and VIP account holders. Among the most important resources, we need to mention that LimeFX provides access to educational resources and assistance from a dedicated account manager.

It even covers some sophisticated trading topics, helping all traders whether they are intermediate or advanced. The broker also has a whole host of analytical tools, allowing users to improve their prediction precision. Those include news, charts, market summaries, calculators, and other related tools.

What is the Offering of LimeFX in LimeFX?

I researched and by reading really good reviews I decided to trust them and I really made the right choice. I am gaining great returns. One of the best broker companies I have dealt with.

However, over time, I persuaded that the broke is worth my trust. I tested it for more than two months and during this period I intensively traded and also made several limefx website withdrawals. The trading process flowed smoothly with no hassle. I requested money to my credit card and on overage it took a day to receive the requested amount.

I love their attitude towards me as well. Smooth and fast transaction including withdrawals. I never had any problem getting my withdrawal request approved.

Yes, LimeFX has a Traders Dashboard in the form of a Trading room, which can be accessed once traders have registered with LimeFX on the official website. CFD brokers are not authorized to give you investing advice. Choose from the deposit methods LimeFX has specially prepared for your account capital injection. To receive training before trading, LimeFX provides a unique and fascinating LimeFX database, including e-books and videos. We are committed to the fair handling of reviews and posts regardless of such relations. Good trading broker.

Like most international brokers, LimeFX does not accept traders from the US. The LimeFX online application form takes less than 20 seconds to complete, offering new traders access to the back office. In compliance with AML/KYC requirements, account verification is mandatory.